Aix/Marseilles, Bourdeaux, Lyon, Paris, and Toulouse Are All Thriving French Tech Innovation Hubs

This article and others have focused on the recent meteoric rise of Paris as an emerging high technology innovation hub. However, there is much more to it than just Paris. There are thriving La French Tech Hubs all over France and in international locations around the World. Both KPMG’s annual global Technology Industry Innovation Survey and the 2019 Startup Genome Global Startup Ecosystem Report have validated the significant advance of France and Paris as a leading innovation center.

Source: Paris, the Rising Hope for a European Silicon Valley | Fast Forward | OZY

WHY YOU SHOULD CARE ABOUT THE RISE OF FRENCH TECH

The French, with their 35-hour workweek and café culture, might be poised to attract the next great tech talent.

Rand Hindi has the quintessential tech guru genesis story. He started coding at age 10 and built a social network by 14. After getting a Ph.D. in artificial intelligence, the entrepreneur set his sights on Silicon Valley. But that’s where the narrative began to fray. Despite all the hype, the Bay Area, known for innovation, felt like a bust. “When you [speak] to people, everybody says they want to do something great,” Hindi says. “But what people really want is to work at Google or sell their company to Google.” So Hindi returned to his native France, started Snips, a company specializing in AI voice technology, and watched his company flourish from three employees in 2013 to 80 today.

As a growing souring on Silicon Valley sinks in, young tech workers aren’t just leaving hot spots like San Francisco and New York, as OZY has previously reported. They are also leaving the country altogether. And while Asia’s — and in particular China’s — tech advances are drawing the world’s attention, it turns out that a growing number of startups are swooning for the City of Love.

For the first time, more than half of respondents to KPMG’s annual global Technology Industry Innovation Survey in 2019 believed that Silicon Valley will no longer be the technology innovation center of the world in four years — due to questions around its escalating cost of living, lack of diversity and troublesome corporate cultures. Cities like Beijing, Tokyo, Shanghai and Taipei are best placed to replace it, the survey suggests. But it’s Paris that is gaining the most steam. After not being ranked in last year’s KPMG survey, it moved up to No. 14 — behind only London among European cities. Other analysts are even more bullish: Paris ranked fourth in the A.T. Kearney Global Cities Report and third in the IESE Business School Cities in Motion Index.

IT MAKES PERFECT SENSE THAT PEOPLE WHO ARE THINKING ENTREPRENEURIALLY WOULD WANT TO BLAZE A DIFFERENT PATH.

ANDREW RUSSELL, SUNY POLYTECHNIC INSTITUTE

Driving this shift is a growing contrast in France’s approach toward global tech innovations to the U.K. and the U.S., experts say. On the one hand, London’s status as a financial and innovation hub stands challenged by Brexit’s enduring uncertainties. And America and Britain are tightening up on immigration. On the other hand, the French government is aggressively courting tech entrepreneurs and investments — a strategy that’s showing results. Paris rents are also 61 percent cheaper than San Francisco’s, according to Numbeo, the crowd-sourced global database of statistics such as consumer prices, perceived crime rates and quality of health care.

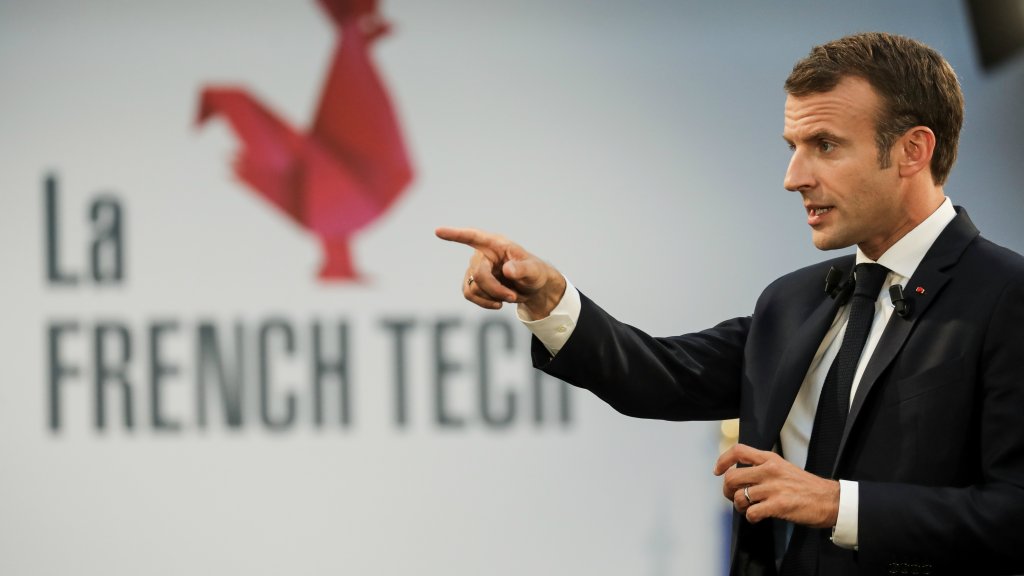

In 2017, the Emmanuel Macron government introduced a program that fast-tracks four-year residence visas for tech entrepreneurs and their families. Since then, French tech startups are witnessing a dramatic increase in funding: There were 743 French startups raising money in 2017, a 45 percent increase from 2016, according to CB Insights. Global giants are taking notice, with both Facebook and Google opening new AI research centers in Paris. Google has even announced plans to create local “hubs” to teach digital skills in other French cities, such as Rennes, with the goal of getting more people online (and using Google products).

The private and nonprofit sectors are pitching in too. Since June 2017, Paris has hosted the 366,000-square-foot Station F, the world’s largest startup incubator, backed by French billionaire Xavier Niel and Iranian-American executive Roxanne Varza. In October 2018, nonprofit StartHer hosted Europe’s biggest startup competition in Paris explicitly catering to female founders, with a record 363 applications from 30 countries. And this March, the French government further expanded access to its tech visa, from around 100 qualifying startups to more than 10,000.

“It makes perfect sense that people who are thinking entrepreneurially would want to blaze a different path” given the high rent, cost of living and income disparities emerging in the Bay Area, says Andrew Russell, dean of the College of Arts & Sciences at SUNY Polytechnic Institute. Cities like Paris see “an opportunity to capture some of the energy” of Silicon Valley “without falling into some of the excesses and toxicity,” Russell adds.

Admittedly, the European market does not hold the same kind of stratospheric (and, to this point, largely unrealized) potential of Asia. But the new buzz around France’s startup scene simply didn’t exist just a few years ago. Hindi remembers the policies of François Hollande being “anti-startup” when the former French president first took over in 2012. But a rising backlash driven by business leaders led to significant change, says Hindi, a former member of the French Digital Council advising on AI and privacy issues.

Before, if your company went bankrupt, you were banned from starting another one for nine years, making students from French business and tech schools risk-averse. That policy has since been scrapped. Tax credits for hiring people were created, and up to 30 percent of a startup’s technology and salary expenses are reimbursed by the French government, allowing French companies to operate at a fraction of the cost of their foreign competitors. Then there’s the tech visa and its expansion.

Those incentives are sorely needed, considering the obstacles France does have. While the country has enough angel investors — and a de facto investor with the government — there isn’t much of an exit market. Unlike American companies, European companies have a tradition of more of a revenue-profit mindset and less of a willingness to take on the (substantial) risk of acquiring a mid-tier player and turning it into a massive, industry-defining giant, Hindi says. They also prefer to invest in goods and services over potentially groundbreaking technology that needs a few years to develop before producing, he adds. The even bigger challenge? The language, which is why London has typically reigned supreme in the European market.

Some of those issues are more perception than reality, say entrepreneurs and tech workers in France. Snips engineer Allen Welkie — who moved to Paris after working at startups along the East Coast of the United States — says many French-based companies are bilingual and that the visa process was simple. A better work-life balance than in the U.S. helps boost retention too, Hindi says. “In Silicon Valley, everybody is fighting for the same few talented people. … If you’re lucky, they’re going to stay a couple of years. How can you build a company if people are constantly leaving?” As San Francisco becomes more and more untenable for everyone but the highest earners, it’s worth asking whether you can build a city that way either.

The Guardian

Source: Boris Johnson is a clown who has united the EU against Britain | Jean Quatremer | Opinion | The Guardian

Friday 25 November 2016 13.36 GMTLast modified on Friday 25 November 2016 14.36 GMT

Britain can be proud of itself. Once again, it had already shown the world the way. In propelling Boris Johnson and Nigel Farage to triumph on 23 June, it demonstrated well before 8 November that Donald Trump was nothing new.

In fact foolishness, vulgarity, inconsistency, and irresponsibility seem actually to be British inventions that have been painstakingly copied – once more – by the Americans.

The age of such drab characters as Margaret Thatcher and David Cameron is over. No more, it appears, must we suffer leaders equipped with a brain and a sense of the common interest. The hour of the political clown has come.

In a few short weeks, Boris Johnson, the former journalist – for whom facts were never an obstacle likely to get in the way of a good story – has succeeded in squandering what little sympathy and understanding was left in Europe for a Great Britain embroiled in the mess of this referendum.

It is quite some diplomatic achievement to have succeeded in uniting, as never before, the 27 remaining members of the European Union – including Germany and the Netherlands – who are all now firmly together in deciding to do the UK no favours whatsoever.

It will be a “hard Brexit” not because that is what Theresa May wants, but because her future ex-partners consider they have no choice faced with a Great Britain so resolutely indecisive.

Johnson has deeply annoyed his continental partners by displaying, firstly, his complete ignorance of the union (perhaps not altogether surprising if you knew him as a “journalist” in Brussels, as I did). According to his very personal interpretation of the European treaties, it is “bollocks” to say that the four fundamental freedoms (free movement of people, goods, services and capital) are inseparable.

“Everybody now has it in their head that every human being has some fundamental God-given right to move wherever they want,” he said earlier this month.

For Johnson, here there can of course be a “dynamic trade relationship and we will take back control of our borders, but we remain an open and welcoming society”.

Yet the German finance minister, Wolfgang Schäuble, warned him very clearly as early as September. “We’ll happily send Her Majesty’s foreign minister a copy of the Lisbon treaty,” he said. “He can then read about the fact that there’s a certain connection between the single market and the four freedoms. At a pinch, I can talk about it in English.”

Schäuble reiterated on 18 November that there “will be no à la carte menu. There is only the whole menu or none.” His Dutch colleague Jeroen Dijsselbloem, meanwhile, hammered the message home: Johnson is spouting stuff that is “intellectually impossible” and “politically unachievable”.

Nevertheless, Johnson repeats his mantra ad infinitum: he is right, and the others are all wrong. The problem, however, is that at the end of the day it is the others who will decide. And if you want something from someone, it is generally wiser to avoid telling them they are an idiot.

But the foreign secretary adds clumsiness to ignorance. Johnson – who has, remember, written a biography of Winston Churchill – does not seem to grasp that it takes a mind with a rare degree of finesse to be able to combine humour and diplomacy.

His quip that the Italians would sell less prosecco to Britain if the UK was not able to stay in the single market not only created a diplomatic incident, but underlined the obvious weakness of the British argument: if the EU risks losing access to a market of 64 million Brits, Britain will lose access to a market of 440 million Europeans.

And last but not least, Johnson, who himself raised the spectre of hordes of Turkish citizens arriving in the UK if it stayed in the union, now steps up as as the most ardent defender there is of Ankara joining the EU – even if it reintroduces the death penalty.

“I can no longer respect this,” raged the normally placid Manfred Weber, leader of the conservative EPP group in the European parliament. “When you want to leave a club, you have no say anymore in the long-term future of this club.”

A famous French screenwriter Michel Audiard coined a phrase in the early 1960s that applies perfectly to Johnson: “Les cons, ça ose tout, c’est même à ça qu’on les reconnaît.” This means, roughly: “Fools” (to choose a relatively inoffensive rendering) “will try anything – that’s how you know they’re fools.”

The foreign secretary, who like Trump is no fan of beating about the bush, will pardon my familiarity. Or perhaps not.