Source: Could Macron and Brexit make Paris Europe’s tech capital?

FRANCE 24

Could Macron and Brexit make France Europe’s tech capital? 🇫🇷

Date created : Latest update :

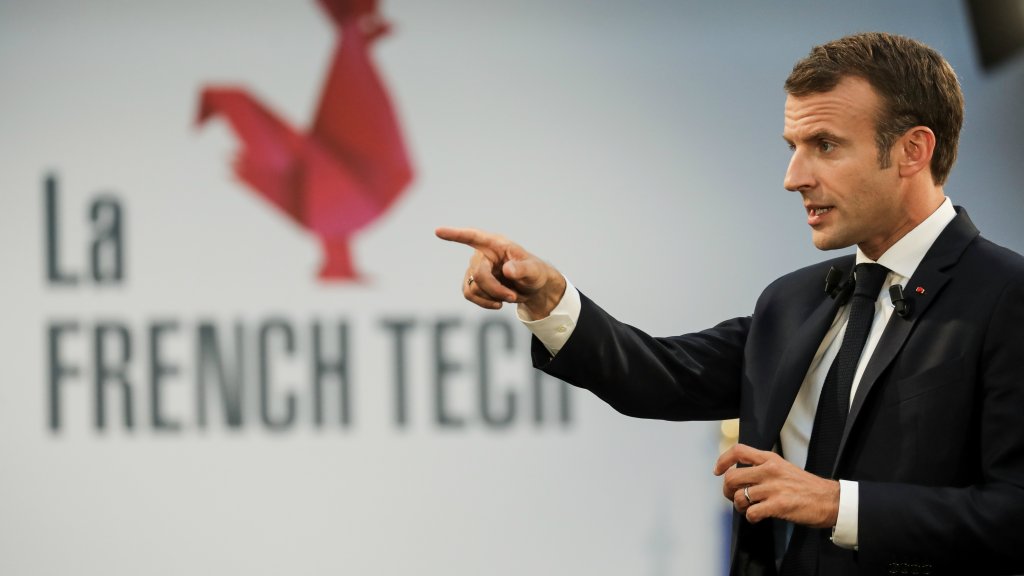

Shortly after his election in May 2017, President Macron said he wanted France itself “to think and move like a start-up” – a vision of the country’s digital future that is gaining traction as Britain wrestles with Brexit.

French President Emmanuel Macron’s vow to make France a ‘start-up nation’ amid the uncertainty over Brexitis raising the question of whether Paris could supplant London as the capital of European tech.

Since his election, Macron has wooed tech entrepreneurs with a string of initiatives in the form of lavish tax breaks, subsidies, and credits for research. In March 2018, he promised to invest €1.5 billion into artificial intelligence research through 2022.

Some of these initiatives, in addition to Macron’s dynamism, have lured British tech companies who are looking to gain a foothold in Europe.

“It made sense to have a European base,” said Cedric Jones*, a Briton who recently launched a start-up at Station F, the cavernous old train station that is now home to the world’s largest start-up campus. “If I’m going to make waves in continental Europe… I wanted to get here before Brexit happened.”

Jones is among dozens of foreign entrepreneurs who have recently launched their start-up at Station F, whose 3,000 desk hub has seen spiraling applications from English-speaking nationals in the last two years.

Some cite political woes back home, the burgeoning French tech sector, or are inspired by Macron’s bid to make Paris the innovation heart of Europe.

“There’s an air of optimism and a can-do spirit in France that I feel we’ve lost somewhat in the US,” said Mark Heath, a New Yorker, who stayed on in France to launch a start-up after studying at INSEAD in 2017.

The Macron effect

Much of the investment in French tech predates Macron’s reforms. The state investment bank Bpifrance, launched by former French president François Hollande in 2013, has been widely credited with developing the sector. Hollande also set up new foreign visas for start-up entrepreneurs.

But Zahir Bouchaary, a Briton who works out of Station F, credits Macron with injecting dynamism into the sector.

“Macron has installed a [start-up] mentality within the French ecosystem itself,” said Bouchaary, adding that it has become much easier to do business in France in the last few years.

“French customers are a lot more willing to work with start-ups than they were before,” said Bouchaary. “France was a very conservative country and our clients were used to working with big old-fashioned companies that have been around for a while. For the past few years, they’ve opened up a lot more to working with younger companies and seem to take more risks than they did before.”

Jones agreed that Macron was “the single variable”. “When he [Macron] goes, the dynamism will go too. I absolutely would not expect that to remain the case if he’s not the president.”

However, although Macron has moved to ease labour laws, Jones said that navigating the country’s labyrinthine bureaucracy in French remained “very burdensome”, and that it was far easier to build a business in the UK. “Whether it’s from a tax perspective or from a legal perspective it’s just so much more complicated.”

UK tech ‘resilient’

The tech scene in London appears to be just as vibrant as ever, explained Albin Serviant, president of Frenchtech in London, who said many UK-based tech entrepreneurs are adopting a “wait and see” approach to Brexit.

“The UK ecosystem is quite resilient,” said Serviant.

“In the first quarter of 2019, there were about €2 billion invested in tech in London. That’s compared to 1.5 billion last year, which is plus 30 percent. And that’s twice as much as France – which invested 1 billion. France is catching up very fast but the investment money is still flowing in the UK,” he added.

Serviant cited London’s business-friendly ecosystem and international talent pool as reasons for why London remains the capital of the European tech sector. Barcelona and Berlin are also contenders for the UK’s tech start-up crown.

Nonetheless, Serviant cautioned against the effects that a hard Brexit would have on the tech sector in the UK.

“‘If Brexit happens in a bad way and if people like me and other entrepreneurs have to leave, obviously that’s very bad for the UK because what makes it very different is the international DNA of London.”

Hard Brexit would not just damage the UK tech sector but would also pose challenges for British developers, who post-Brexit may need a carte de séjour to work in the country, looking to find work in France.

Sarah Pedroza, co-managing director of Hello Tomorrow technologies, a Paris-based startup NGO, said that if she had to choose between hiring a British national and an EU citizen with the same skillset, she would opt for an EU citizen because there would be less paperwork involved.

Brexit aside, others suggest that France is snapping at the UK’s technological heels.

“I do think France has the potential under Macron to close the gap with the UK,” said Jones.

“The single biggest factor in what’s going on for France is that France is developing a sense of confidence in itself, in its start-up scene, as a tech hub, that’s being helped by France and that’s also being helped by Brexit.”

Since starting in 2001, The Icehouse has worked with over 250 startups to help them accelerate their growth. The alumni pool includes some of NZ’s most successful startups such as M-com, PowerbyProxi, eBus as well as many emerging businesses and brands such as DirtyMan, Tomette, LiveLink Connect and Biomatters.

Since starting in 2001, The Icehouse has worked with over 250 startups to help them accelerate their growth. The alumni pool includes some of NZ’s most successful startups such as M-com, PowerbyProxi, eBus as well as many emerging businesses and brands such as DirtyMan, Tomette, LiveLink Connect and Biomatters.